Accretive Cleantech Finance Private Limited is now Ecofy Finance Private Limited

EXPLORING 2 & 3-WHEELER EV LOAN OPTIONS IN INDIA: KEY FACTORS TO CONSIDER BEFORE YOU BUY

- Publish on Sep 16, 2024

- Read Time 5 min

Explore 2 and 3-wheeler EV loan options in India, including interest rates, government incentives, loan tenure, and tips for securing the best financing. Discover how Ecofy makes owning an electric vehicle affordable with customized green loan solutions.

Electric vehicles (EVs) are revolutionizing India's transportation landscape, offering eco-friendly alternatives to traditional internal combustion engine vehicles. As the demand for scooter or motorcycle EVs surges, understanding the financing options becomes crucial for prospective buyers. This guide delves into the EV loan landscape in India, highlighting key factors to consider before making a purchase.

Understanding 2 & 3-Wheeler EV Loans in India

An EV loan is a financial product designed to assist consumers in purchasing electric vehicles. These loans typically cover a significant portion of the vehicle's cost, allowing buyers to repay the amount over a specified tenure with added interest. With the occurring green vehicle trends, EV loan options have made the purchase of 2 or 3 wheelers EV’s quite easy.

Interest Rates and Loan Tenure

Interest rates for 2 or 3-wheeler EV loans in India vary based on the lender, loan amount, tenure, and the applicant's credit profile. Interest rate ranges are less in comparison to other loans. Some banks offer concessions on interest rates for EV loans compared to traditional vehicle loans. Loan tenures typically depend on the requirements, allowing borrowers to choose a repayment period that aligns with their financial situation.

Loan-to-Value Ratio (LTV)

The LTV ratio indicates the percentage of the vehicle's cost that a lender is willing to finance. For EV loans in India, many banks offer up good benefits, reducing the need for a substantial down payment. However, the exact LTV ratio may vary based on the lender's policies and the applicant's creditworthiness.

Government Incentives and Subsidies for 2 & 3-Wheeler EV Loans in India

- PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) Scheme: This scheme promotes EV adoption. Running from October 1, 2024, to March 31, 2026, it offers subsidies for various electric vehicles and grants for infrastructure, including e-buses and charging stations. It also supports education, awareness, and management to enhance EV uptake across India.

- State-Level Incentives: Various states offer additional benefits such as road tax exemptions, registration fee waivers, and direct subsidies. For example, Delhi provides a road tax and registration fee exemption for 2 or 3-wheeler EVs.

Factors to Consider Before Applying for an EV Loan

- Credit Score: A higher credit score can secure better interest rates and loan terms.

- Down Payment: While some lenders offer up to 100% financing, making a down payment can reduce the loan amount and interest burden.

- Processing Fees: Be aware of any processing or documentation fees associated with the loan.

- Prepayment Charges: Check if the lender imposes penalties for early repayment of the loan.

- Additional Services: Some lenders, like Ecofy, offer bundled services such as insurance, annual maintenance contracts, and guaranteed buyback options, enhancing the overall value proposition.

How Ecofy Can Help as a Green Loan Provider

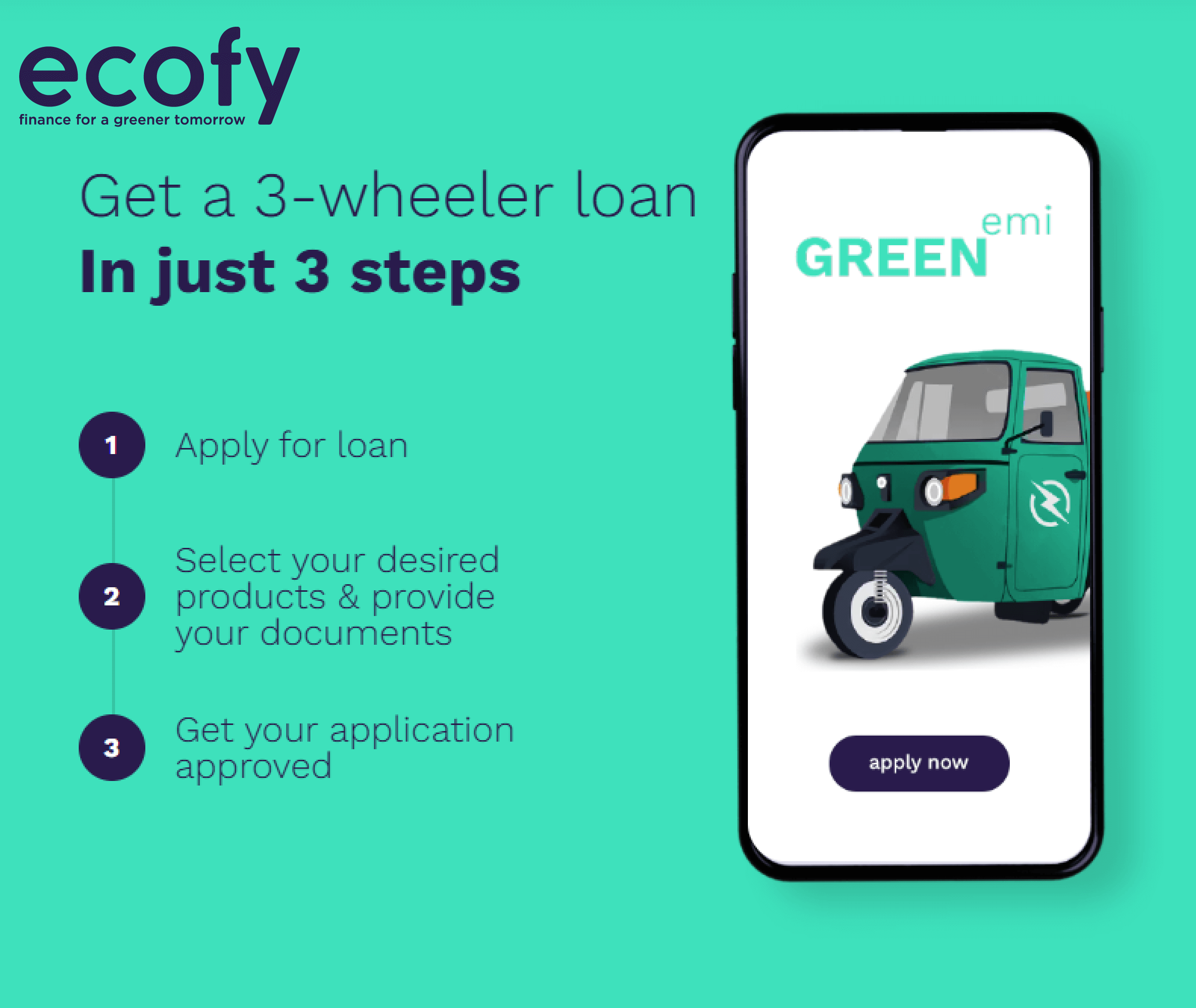

Ecofy, a dedicated green financing platform, is uniquely positioned to support India’s transition to sustainable transportation. Specializing in electric two-wheeler and three-wheeler financing, Ecofy offers tailored loan products designed to make owning an electric vehicle more affordable and accessible.

Why Choose Ecofy for EV Loans in India?

- Customized Loan Solutions: Ecofy provides flexible financing options tailored to suit different budgets and needs, ensuring you find a plan that aligns with your financial goals.

- Affordable Interest Rates: With competitive interest rates, Ecofy ensures that the cost of financing your EV remains manageable, enabling more people to shift towards sustainable transportation.

- Minimal Paperwork and Quick Processing: The application process is designed to be hassle-free and is 100% digitized, with minimal documentation requirements and faster approval times, making it easier for you to own an EV without unnecessary delays.

- Additional Value-Added Services: Ecofy goes beyond just financing, offering bundled services such as:

- Insurance plans to safeguard your investment.

- Annual Maintenance Contracts through partnerships with service providers to keep your EV in optimal condition year-round.

Easy Steps to Apply for an Ecofy EV Loan in India:

- Explore Options: Visit Ecofy's website to review financing options tailored for electric two-wheelers and three-wheelers.

- Submit Your Application: Fill out a simple online form with basic details.

- Approval and Disbursement: Enjoy quick approval and seamless disbursement to take your EV home without any delay.

With Ecofy, owning an electric vehicle is not just an investment in a better future but a step toward empowering a sustainable lifestyle. Choose Ecofy as your financing partner and drive towards a greener tomorrow.

Conclusion

Transitioning to an electric vehicle is a significant step towards sustainable living. Understanding the various EV loan options, interest rates, government incentives, and regional considerations can empower you to make an informed decision. By evaluating these factors, you can choose a financing option that aligns with your financial goals and contributes to a greener future.

FAQs

- What is EV 2-Wheeler Interest Rate

- Suggest an EV 2-Wheeler Calculator

- Suggest EV-3 Wheeler Loan in India

- Best EV 3-Wheeler Loan